More customers.

This is what every eCommerce business wants, and the reason is simple.

The more paying customers a business gets, the more revenue and profit they stand to make.

But the issue is getting more customers isn’t always linear. There’s a lot that goes into customer acquisition strategy. And it’s critical – if you want to be profitable– to ensure that your acquisition cost is lower than the customer lifetime value (CLV).

A sustainable business should have a CLV to CAC ratio of 3:1. This means that for every dollar you spend acquiring customers, you should get three dollars back.

With that said, how do you reduce your CAC to ensure profitability? Well, many strategies are proposed all over the internet. But not all of them are effective.

In this article, we will focus on one tried-and-tested method of reducing CAC. And that method is called Conversion Rate Optimization. We’ve used this method over the years to help ecommerce companies bring down their customer acquisition costs – and in this article, we’re going to show how we exactly did that.

But before we delve into that, let’s start by looking at what customer acquisition cost is, how to calculate it, and what’s the industry average for e-commerce businesses.

What is Customer Acquisition Cost, and how to Calculate it?

Customer acquisition cost, also known as CAC, is the amount a business spends to get a new customer.

To calculate CAC, you need to add up the costs associated with getting new customers over a period of time, and divide that figure by the number of customers you got in that period of time.

For instance, if you spend $10 on an advertising campaign and you get five new customers through that campaign. Your CAC is $2.

CAC = Cost of Sales + Cost of Marketing / New customers acquired

This formula is simple and direct, but when calculating it, make sure to add marketing and sales expense.

Some expenses might be obvious, others not too noticeable. Listed below are some expenses to include.

1. Employee salaries.

2. Tech stack costs.

3. Ad spend.

4. Content production cost

5. Inventory maintenance cost.

How Does Customer Lifetime Value Impacts Customer Acquisition Cost?

Customer lifetime value, aka CLV, is a metric that measures how much revenue you’ll make from a customer for as long as they purchase from you.

To get a good insight into your overall business health, it’s good to know the ratio of customer lifetime value to customer acquisition costs.

If your business runs a subscription plan, the lifetime value of your subscribed customers will give your CAC a good boost.

Professional tip: if you don’t offer subscription plans, consider a loyalty program, it’s also a great way to retain customers for long.

Here’s a scenario to consider:

Assuming your CAC is $150 per customer, and you get 3000 customers in a fiscal year, your total expenditure will be – $450,000.

However, if each of these customers stays with your business for three years and spends $50 with you monthly, the LTV of each customer will be – $1650.

$50 per month x 36 months = $1800

$1800 – $150 CAC = $1650

Multiply that figure by your 3,000 customers, and you get $4,950,000.

Looking at the figure of $4,950,000, this is way more than the costs of acquiring new customers.

To calculate LTV – average revenue per customer/churn.

As mentioned in the intro, to have a healthy business, you should always ensure that your CAC is lower than LTV. The ideal ratio of LTV to CAC should be 3:1.

To calculate this ratio, divide the LTV by CAC and simplify it in its lowest terms.

What is A Good Customer Acquisition Cost?

Average customer acquisition cost varies from industry to industry. To define a good CAC, you must identify the space you’re playing in.

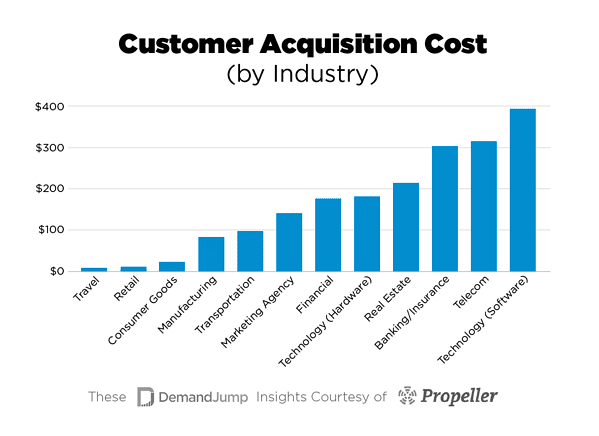

According to Propeller, these are the CAC average across different industries;

- Travel: $7

- Retail: $10

- Consumer Goods: $22

- Manufacturing: $83

- Transportation: $98

- Marketing agency: $141

- Financial: $175

- Technology (hardware): $182

- Real estate: $213

- Banking/insurance: $303

- Telecom: $315

- Technology (software): $395.

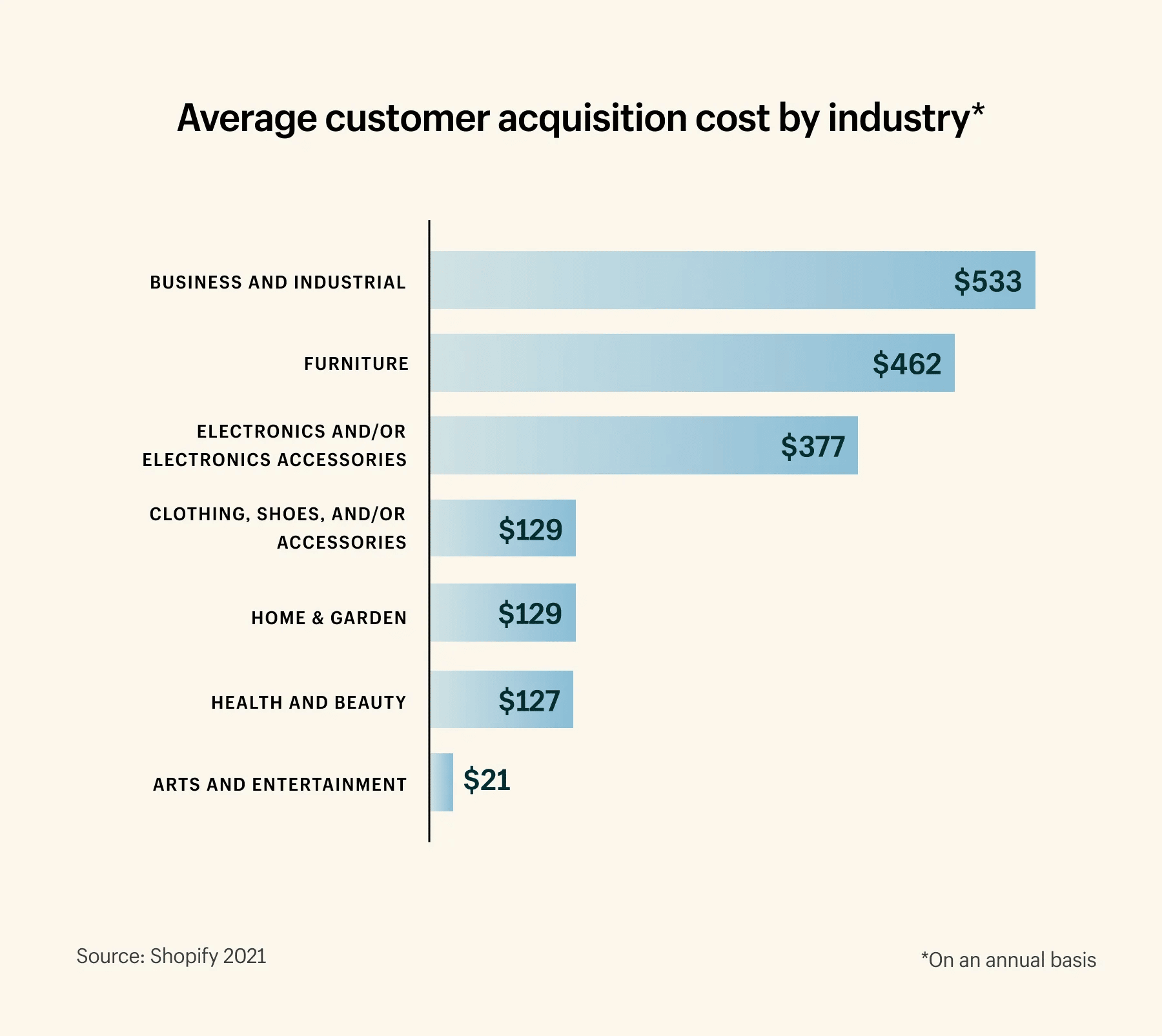

Specific to eCommerce, according to a study by Shopify, brands with less than four employees have these customer acquisition costs;

- Arts and entertainment: $21

- Business and industrial: $533

- Clothing, shoes, and/or accessories: $129

- Electronics and/or electronics accessories: $377

- Food, beverages, and tobacco products: $462

- Health and beauty: $127

- Home and garden: $129

One reason why it’s good to know your industry’s CAC average is that it can help you plan out your marketing and sales budget.

Also, as a business, if you don’t have enough cash to throw around to get as many paying customers as you’ll like, that means you’ll have to get creative on how to reduce the CAC in your industry, and we’re going to look at that in the next section.

Reducing Customer Acquisition Cost: how CRO helps.

1. By running A/B tests.

Suppose you don’t know what an A/B test is, here is a quick definition:

An A/B test is when two designs ( an original and a variation) are shown to website visitors with a change in one element (this could be a headline or call-to-action) to see which design performs better.

How A/B tests help bring down customer acquisition costs is simple, and it’s by understanding the role of the customer acquisition funnel.

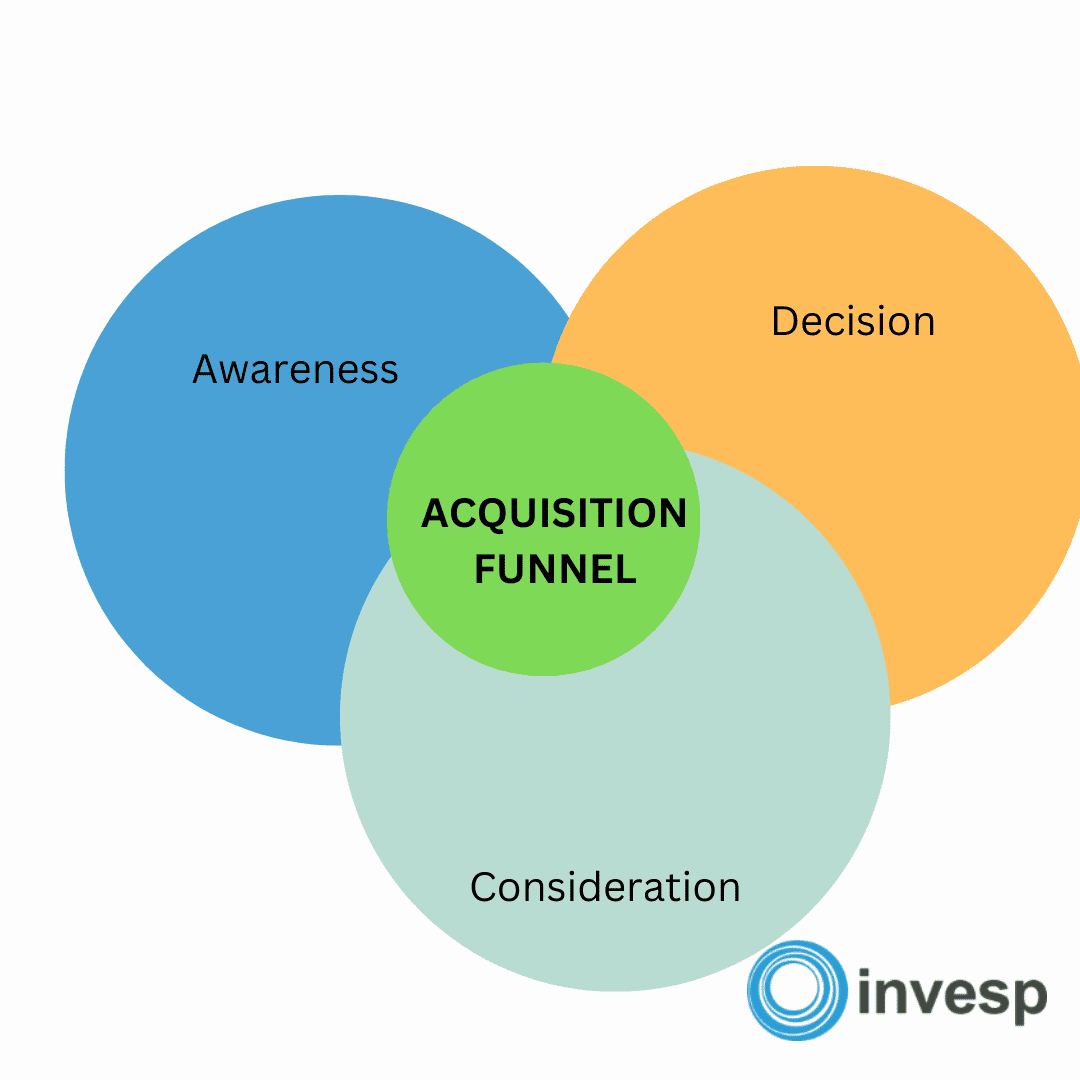

The typical acquisition funnels look like this;

Awareness: in this stage, you’re getting the word out about who you are, what your business does, how it serves your target audience, and how you’re different. To get the word out, you can run paid ads, through referrals, SEO efforts, etc.

Consideration: here, you’ve gotten the attention and interest of your audience, and they’re considering taking action, which could be signing up for your email list to see your offers, etc.

Decision: you have held their interest for a while, they’ve seen your offers and compared you with the competition, and if you’re appealing enough, they might make a purchase, join your loyalty program, etc.

In every step of the acquisition funnel, A/B tests play a significant role in driving a larger percentage of your leads down the funnel. This is possible by testing different elements and components.

Take, for instance, the awareness stage; you could test paid ads against referral networks to see which one brings in the most qualified leads. If you notice more leads coming through paid ads, you know to focus your marketing efforts there.

In the consideration stage, let’s say you have 5000 new subscribers just come in; before sending a campaign blast, you could send two different campaigns to a portion (10%), see how they respond to it, then send the winner to the remaining 90% audience and get more conversions from them.

In the decision stage, one of the things you can A/B test as you see a flood of potential customers come through is your checkout process and how easy and convenient it is.

One-step vs. multiple steps checkout, creating an account vs. using an existing Gmail account, etc.

This is how A/B tests help lower CAC as customers come through your acquisition funnel.

Here are some A/B Testing Mistakes To Avoid When Trying To Lower CAC.

- Running too many split tests at once.

- Not clearly defining your metrics

- Not running a test until it achieves statistical significance.

Apart from the A/B test examples cited for the acquisition funnel, there are other categories of A/B tests you can run on your site to improve customer experience and lower CAC.

-

Element Level testing:

This is the first level of A/B tests, and it’s the easiest. You can test a headline against a variation, a different button copy or color, etc.

Element-level testing requires the least effort, it’s the easiest to implement, and it has the most negligible impact on your bottom line most of the time.

-

Page-level testing:

This is a step harder than element-level testing. You’re removing things from the page; you move things around, introduce new things on the page, etc. You’ll want to spend 60 – 70% of your time here because it can get more complex.

-

Visitors flow testing:

This is one of the more complex tests to carry out. When conducting this A/B test, you want to change how a visitor navigates through your WordPress site e.g, a single-step checkout vs. a multiple-step checkout. Getting a winner here can significantly impact your bottom line.

-

Messaging:

This is an interesting test because it could span multiple elements and pages on your website. The hard work in this type of A/B test is not the actual A/B test but figuring out the messaging and making sure it’s consistent and there’s no disconnect between the pages and elements.

-

Element emphasis:

This A/B test seeks to answer the question of how often you want to emphasize an element. Questions like do I need to show this element once? When do I have to show this element? etc. This A/B test also requires some thinking.

Note: the reason for these A/B tests is to find the site design that will increase your conversions and improve customer experience.

This is because a happy customer will purchase more from you, which will increase their LTV with your business, which, compared to CAC, makes the effort worthwhile.

2. A/B test your campaigns

The first A/B test covered everything that happens on your site. This set of A/B tests refers to what happens on your paid ads campaign.

To reduce CAC running paid ads, you need to make your ads look more like in-feed content.

In-feed content refers to content that feels natural to a social media network.

The reason many ads have high CAC and low conversions is because such ads look like ads and not in-feed content. Your audience doesn’t want to be marketed to.

To consistently bring down CAC with paid ads, here’s a checklist you can follow;

- Test your ad creatives to know which one your audience resonates with best (videos vs. images vs. infographics).

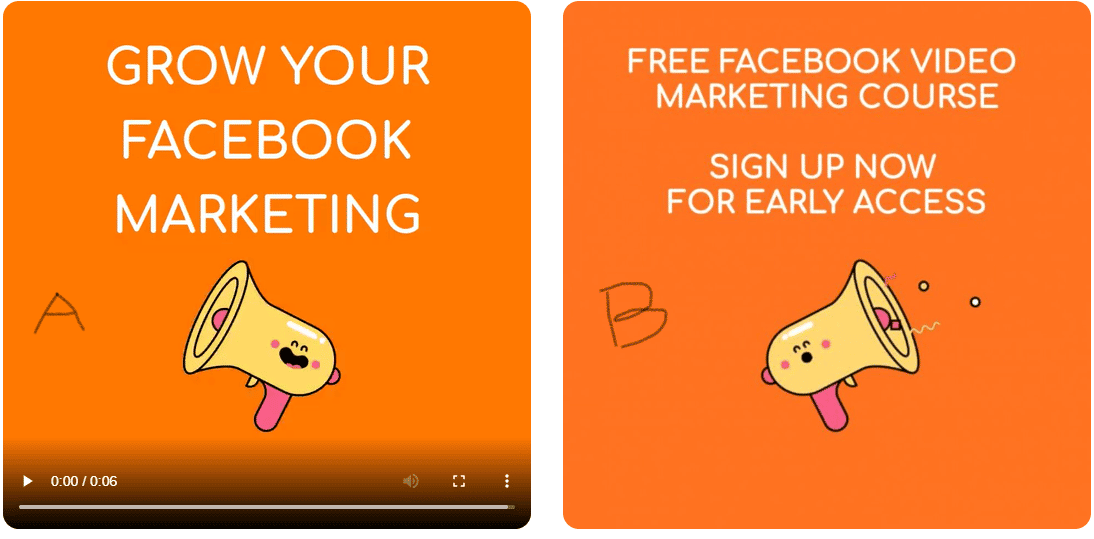

See this example from Biteable;

They ran ad A, a 6-second video, against ad B, a static image, just to A/B test and see which one would get more reach, clicks, and generate leads.

The video ad won. This isn’t to make a case that video ads win every time; experiment, see what works best for your audience, and do more of it.

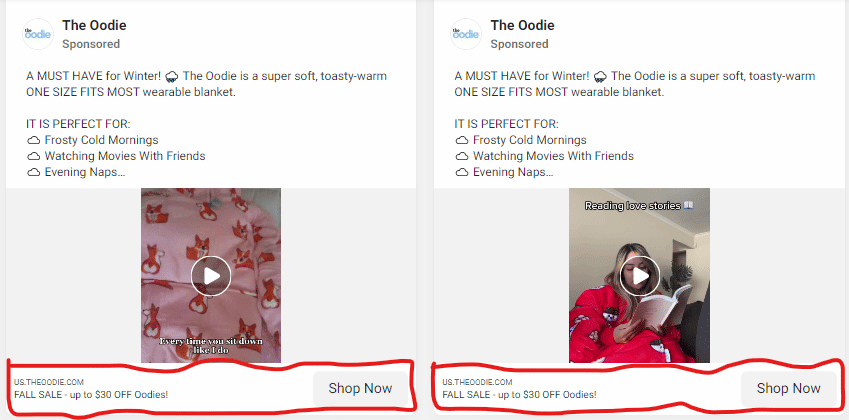

Here’s another example, and it’s from The Oodie:

In these ads, you can see they’re using the same copy, the same headline and CTA, but different videos.

You can do this for your business too. To reduce CAC, and increase conversions, experiment with different elements to see which one drives more conversions.

- Test your ad copy (short vs. long).

- Also, test ad CTA (not all call-to-action motivate readers to take action).

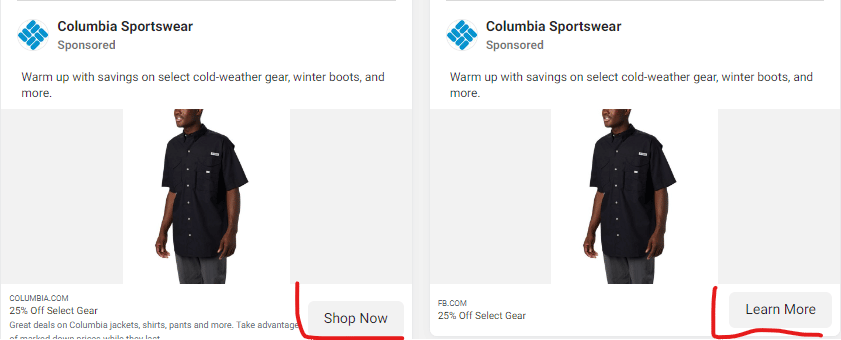

See this example from Columbia sportswear:

Every element remains the same in both ads, except for the call-to-action. The first says ‘shop now, and the second reads ‘learn more.

I don’t have access to the results of this A/B test, but if I was to guess, I’d say the ad with the ‘shop now’ CTA should see more conversions, but you can’t be too sure.

You can do the same for your brand and test different CTA’s to see which resonates with your audience best.

- Ad copy intro ( question vs. key statistic vs. statement).

- You can also A/B test ad angle.

Here’s an example from Maisonette.

Everything remains the same in both ads (the CTA and headline), but the ad angle is different. In the first one, the product is projected as ‘the season best styles,) in the second ad, the ad angle has changed, and readers are encouraged to shop for the ‘world’s best brand for kids.)

Sharp contrast in ad perspective, it’ll be difficult to say which of the ads pulled in more sales, but it’s something you can try for your ads, testing different ad angles.

Note: Consistent A/B testing your ads ensures you’re always staying ahead of the customer interest decline curve, increasing your conversions and decreasing your customer acquisition costs.

3. Speak to users

Conversion research is a great way to gain direct insight from your site visitors that inform your marketing efforts (paid, organic), which can ultimately reduce your customer acquisition cost.

There are two sets of audiences you want to talk to,

- Non-purchasers, and

- Purchasers.

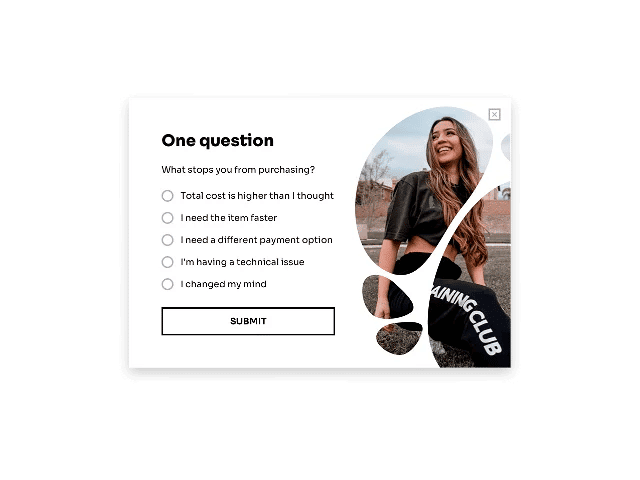

For the first segment, you can set up surveys that trigger when they want to exit your site, asking them why they’re yet to purchase.

This is good for uncovering friction and customer pain points. With these insights, you can tackle head on every customer issue and increase your conversions.

The truth is this, the easier it is for customers to purchase from you, the longer they spend with you and purchase from you, which feeds into their LTV.

Here are some best practices when creating your exit intent survey;

- Make sure your form is visible and central.

- Test your form. Make sure it is easy to fill on different devices and screens. You can use Browserstack for that.

- Keep your question short and close-ended.

For the second segment, you want to sit down and have a chat with them about

- why they purchased from you,

- what aided their decision to purchase,

- what they use your product for,

- Any objection they had.

This chat is a typical jobs-to-be-done interview. This is key because it helps you identify what’s working so you can double down on it.

You also identify how users see your product and use them (this can influence your product positioning and branding).

Here are some JTBD best practices;

- Never ask leading questions (this biases the response).

- Always ask open-ended questions.

- Listen more than you talk.

All these insights gathered from purchasers and non-purchasers build a library of customer insights which, when implemented, go a long way to build a positive customer experience and inform marketing efforts which lower acquisition costs.

Wrapping Up

There’s no business around today that doesn’t need customers.

But if you’re not careful, you’ll spend all of your marketing budgets trying to get new customers but converting a tiny fraction of them.

Reducing CAC is no mean feat, but it’s possible if you follow every step in this article and implement them.